How to sell on Walmart US Marketplace as a non-US seller?

Complete guide on the eligibility and how to apply to sell on Walmart for non-US vendors.

Approved Solution Provider

See 100+ of our 5-star reviews on TrustPilot, Google Maps, and Capterra.

Step 1 – Check Eligibility

When multiple merchants sell the same item on Walmart.com, all offers are shown on one page. However, only one offer wins the Buy Box, and this seller takes the vast majority of sales.

Walmart accepts seller applications from certain non-US countries with fewer restrictions regarding business requirements. Walmart continuously adds new countries to the list. As of February 2025, the eligible countries include:

- Canada

- China

- Chile

- Germany

- Hong Kong

- India

- Japan

- Mexico

- Singapore

- South Korea

- Taiwan

- Thailand

- Turkey

- United Kingdom of Great Britain and Northern Ireland

- Vietnam

Minimum Qualifications

- Your business must be incorporated in the US or in one of the countries listed above.

- You need supporting documents to verify your business name and address.

- You must have at least one year of marketplace or eCommerce success, indicated by good product reviews and solid numbers demonstrating your business’s profitability.

- Products must have GTIN/UPC GS1 Company Prefix Numbers.

- Your catalog must comply with Walmart’s Prohibited Products Policy (see details).

- You must have a warehouse capable of handling returns (see details below).

Required Documents

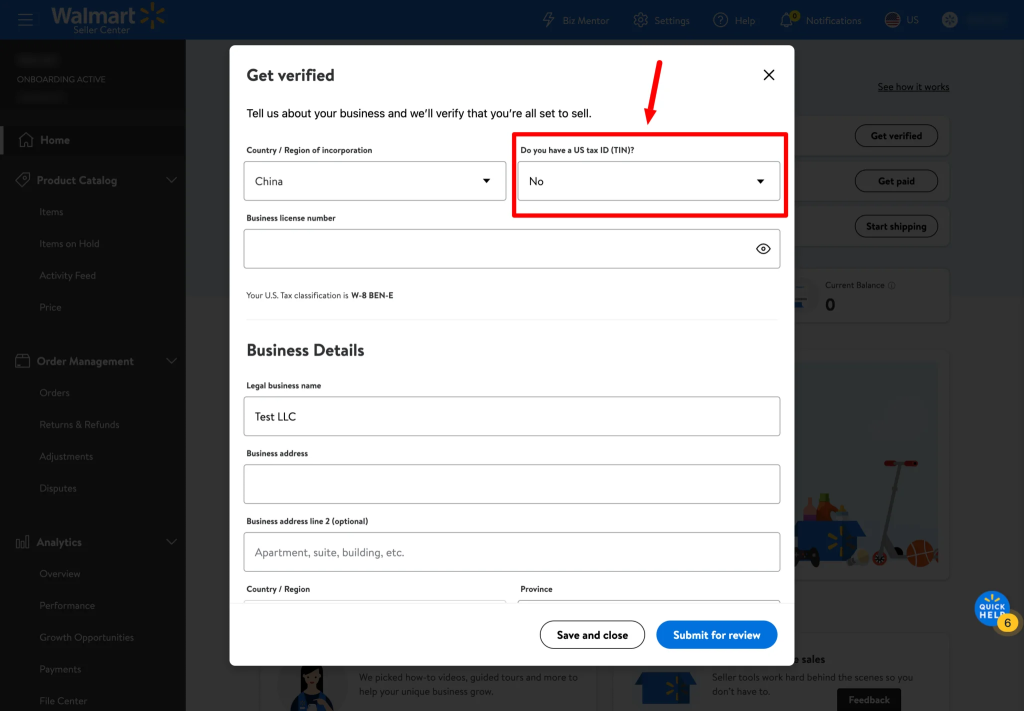

If your country is eligible for application, you will submit the application as a foreign entity. During the application process, Walmart will inquire about a US Tax ID; if you don’t have one, simply indicate so. You will still be eligible to sell on Walmart as an international seller using the W-8BEN-E form for tax reporting.

Eligibility requirements frequently change, and depending on your country, you may need to provide various documents or even have a US Tax ID and LLC entity in the US, although specific guidance cannot be provided as rules often vary by country.

This table shows the required proof needed for W-8BEN-E and W-8BEN sellers from the countries listed above.

This table was updated in February 2025, based on information from the Walmart page.

| Canada | 1. Notice of Assessment (NOA) or Articles of Incorporation (AOI) or Articles of Amalgamation or Notice of Registration (Québec Only). 2. Utility bill or bank statement within last six months. |

| Chile | 1. Chile Government issued Rol Único Tributario (RUT) Certificate. 2. Utility bill or bank statement for the business within the last six months. |

| China | 1. Colored copy of your business license, stamped with your company chop (seal). 2. Letter of Authorization, signed by your business’s Legal Representative and stamped with your company chop. 3. Colored copy of the personal ID card of the Business Legal Representative stamped with your company chop. |

| Germany | 1. Certificate of Commercial Registration. 2. Utility bill or bank statement for the business within the last six months. |

| Hong Kong | 1. Copy of your Business Registration Certificate, stamped with your company chop (seal). 2. Copy of your Certification of Incorporation stamped with your company chop. 3. Letter of Authorization, signed by your Business’s Director and stamped with your company chop. |

| India (excluding sole proprietors) | 1. Utility bill or bank statement, with address listed, dated within six months (mandatory). 2. GST Registration Certificate (mandatory). |

| India (sole proprietors only) | 1. Proof of address for rental properties: Rental agreement and No Objection Certificate (NOC). 2. Proof of address for self-owned properties: Utility bill that is less than 90 days old. 3. Micro, Small and Medium Enterprises (MSME). 4. Shop and Establishment License. 5. Goods and Services Tax Identification Number (GSTIN) Registration Certificate. |

| Japan | 1. Certificate of All Present Matters. 2. Utility bill or bank statement within the last six months. |

| Mexico | Mexico 1. Tax Identification Card (Cédula de Identificación Fiscal). 2. Articles of Incorporation. 3. Utility bill or bank statement within the last three months. Mexico – Individuals 1. Taxpayer Identification Card (Constancia de situacion Fiscal). 2. Utility bill or bank statement within the last three months. |

| Singapore | 1. Certificate of Registration or Certification of Incorporation issued by the Accounting and Corporate Regulatory Authority of Singapore (ACRA). 2. Utility bill or bank statement within the last six months. |

| South Korea | 1. Business Registration Certificate issued by the National Tax Service. 2. Utility bill or bank statement within the last six months. |

| Taiwan | 1. Business (Company) Registration Certificate. 2. Personal ID card of the business’ legal representative in color (front and back). |

| Thailand | 1. Thailand Tax Identification Number (TH-TIN). 2. Utility bill or bank statement within the last six months. |

| Turkey | 1. Trade Certificate of Registry (Ticaret Sicil Tasdiknamesi) or Certificate of Activity (Faaliyet Belgesi). 2. Tax Registration Certificate. 3. Utility bill or bank statement within the last six months. |

| United Kingdom of Great Britain and Northern Ireland | 1. Certificate of Incorporation. 2. Utility bill or bank statement within the last six months. |

| Vietnam | 1. Certificate of Enterprise Registration. 2. Bank statement or utility bill within the last six months. |

US Phone Number

You will need to provide the US phone support number. There are many options available, for example, a company Sonetel.com.

US Return Address

Sellers must provide a US address for returns (P.O. boxes are not accepted). This is typically a 3PL (Third-Party Logistics) company that you will use for shipping from within the US. If you are seeking quality 3PL companies, please refer to our integrations section, where we list several third-party fulfillment companies we recommend. Please note, you will not need the return address if you participate in the Walmart WFS (Walmart Fulfillment Services) program, as Walmart will handle the returns.

Step 2 – Registration

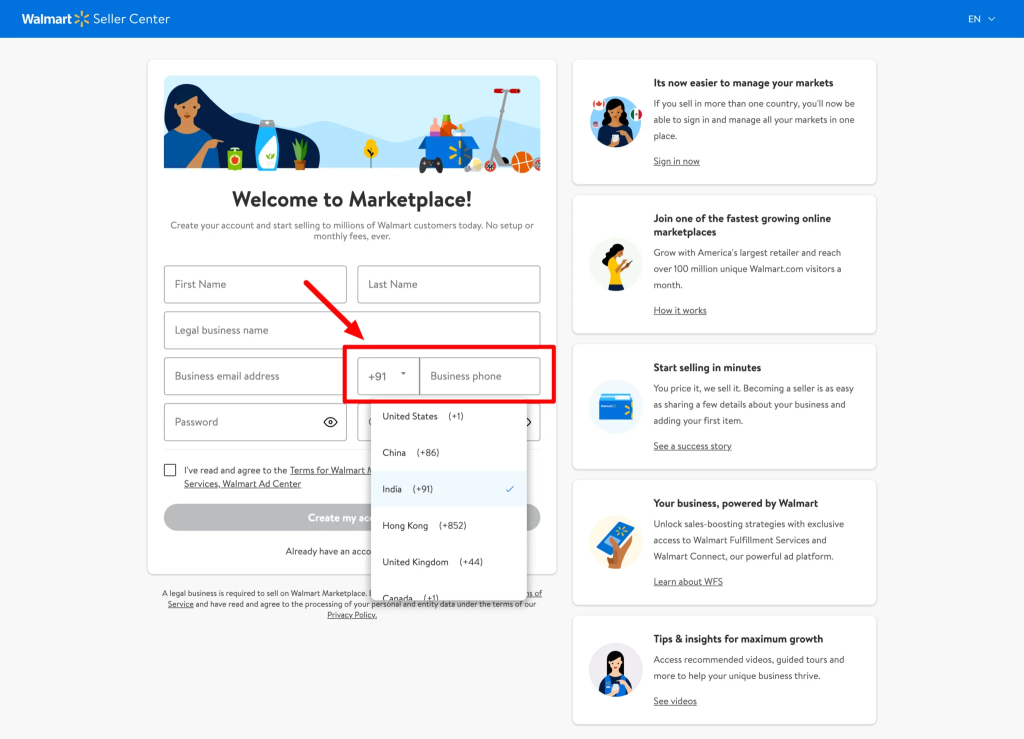

To apply, go to the application form and accurately provide the requested information.

- Ensure that the phone number you select is from the country for which you claim eligibility. For example, if you apply as an Indian company, make sure you select and provide your Indian business phone number.

- Enter the business name as it appears on your official documents.

- Use your business email address; do not use @Gmail.com, @Yahoo.com, or any other similar providers.

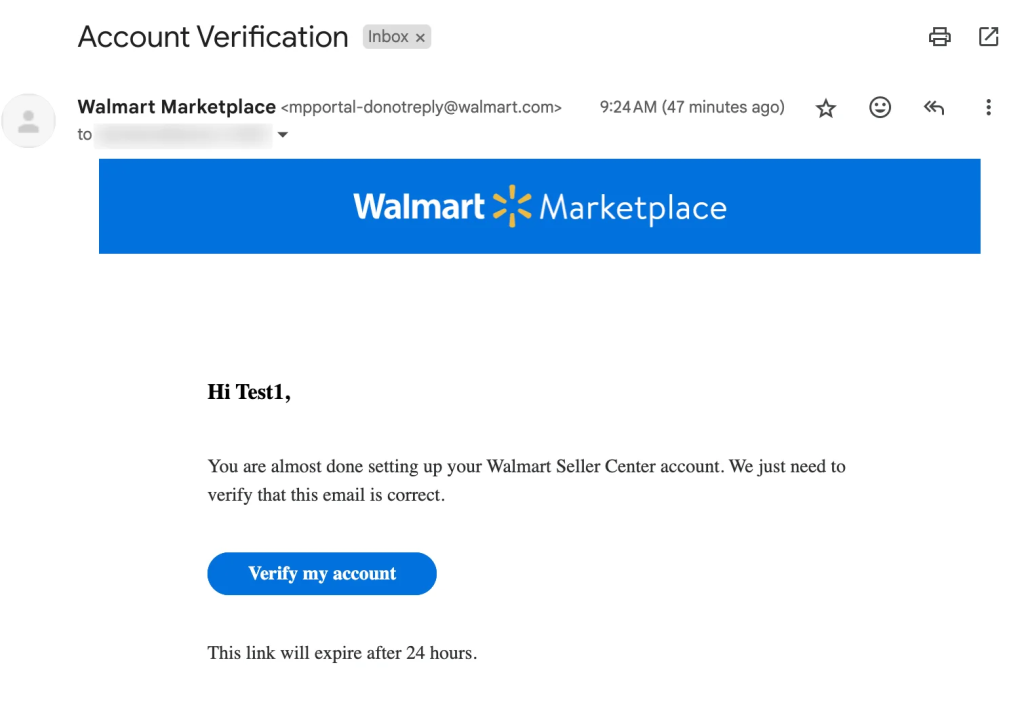

After you submit the form, you will receive a verification email. From there, you should have access to your Walmart Seller Center.

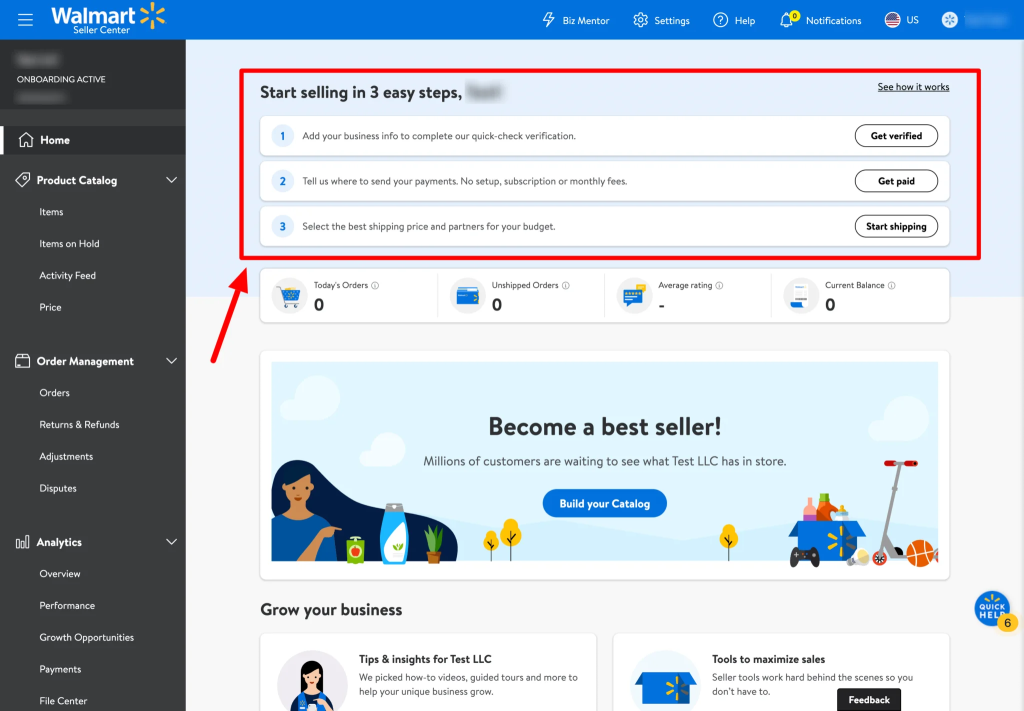

Step 3 – Account Verification

This is the most crucial part, and you need to ensure you fill out all the forms and provide all the documents accurately. Do not make typos, and upload all the required documents. Any mistake will extend the process and likely lead to your account being automatically rejected.

Your business details MUST be entered exactly as they appear in your IRS records or other government-issued documents.

During the verification process, if you are asked for a US tax ID and don’t have one, simply select “No” and provide information about your home country business.

Business Verification can vary from a few minutes to two business days.

If your Business Verification status says “Failed,” this means Walmart is unable to verify the information provided. You need to review your business information and try resubmitting with the corrected information. If you still have trouble, contact Seller Support through the following path: Business Verification Questions and Issues > Verifying Status Update Questions.

What to do if your country is not eligible at the moment?

Walmart regularly adds new countries to the list, but it is hard to tell when your country will be eligible. You have a few options.

- Create the US entity and start doing business in the US

You will need to create a company in the US to get your US Tax ID. We encourage you to hire a professional firm to help with taxes, getting a local address, filing for forming the company, and getting your US bank account.

Please note that before you apply to Walmart, you should first try to run your business in the US for at least a year, to establish your presence in the US and be able to show on your Walmart application your sales and your presence on other US marketplaces like eBay, or Amazon (make sure your reviews on those platforms are very good, as this is one of the indicators showing the quality of your offering). - Find local resellers

You might want to look for a local US company that already sells on Walmart and work with them directly, providing your inventory and making them your official reseller.

Selling on Walmart DSV, Canada, and Mexico as a non-US seller

We strongly suggest selling on Walmart US Marketplace first and then expanding to other Walmart platforms. Instead of trying to join Canada and Mexico marketplaces, a seller should establish its presence on Walmart US first. Selling for several months on Walmart.com as a 3P seller, you will learn how the marketplace works, gain experience, and confirm that the products you offer are in demand among Walmart shoppers. With your Walmart US account in good standing, you will be eligible to apply to sell on Walmart Canada and Mexico.

Doing business with Walmart as a DSV seller is available for selected merchants only, not all the companies are eligible. This program is designed for sellers with products proven to be in demand on Walmart.com. Usually, this is the Walmart team who contacts eligible sellers and invites them to the DSV program. However, if you operate an established business with products you believe will do very well on Walmart, you can contact us via this form to request more information on the DSV program.